How to Get Health Insurance without a Job – Overview

The loss of a job is more than the loss of income. It is also the lack of health insurance. Without a reliable source of income, it becomes difficult for individuals to pay for health insurance.

However, there are several ways to get health insurance without a job. It would help if you acted fast to secure the best-suited and most affordable unemployed health insurance policies.

When you lose your job, you may qualify for a Special Enrollment Period in the health insurance marketplace regulated by the federal government, which allows you to enroll in a plan outside the annual Open Enrollment Period.

During this period, you can purchase private health insurance, which can offer more flexibility compared to standard employer-sponsored insurance coverage.

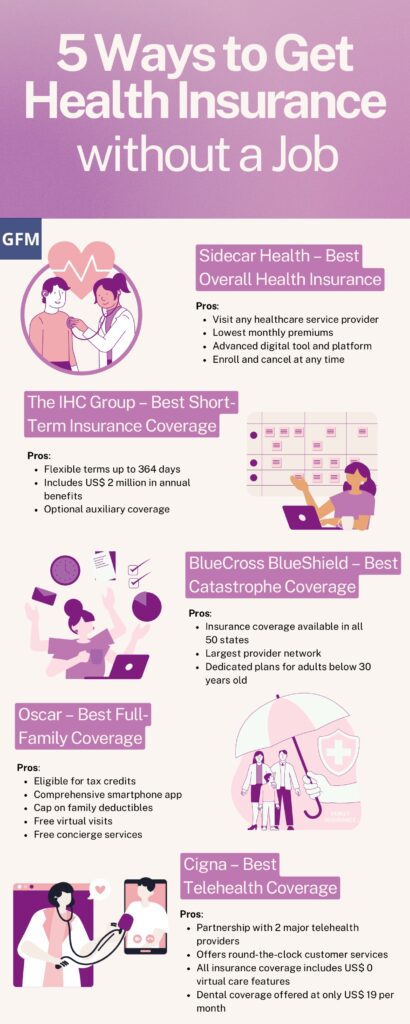

5 Ways to Get Health Insurance without a Job

Here are some of the best ways to get health insurance without a job:

1 – Sidecar Health – Best Overall Health Insurance

Sidecar Health offers Access Plans that may provide an alternative to traditional health insurance, but they are not classified as traditional health insurance. Their offerings are based on a cash payment model that may not be suitable for everyone.

The insurance carrier has introduced innovations such as the Sidecar payment card, designed to offer a new way to manage and pay for healthcare services.

As you are technically paying the expenses of healthcare services out-of-pocket, you are not restricted to visiting only those doctors and hospitals under its coverage.

In contrast to standard insurance, you can sign up for coverage anytime, as there are no open enrolment periods to worry about.

You can buy Sidecar Health insurance plans online or through the Sidecar Health smartphone app by filling out and submitting a short application form.

You can choose 1 of 3 pre-configured insurance policies or create custom coverage.

Pros:

- Visit any healthcare service provider

- Lowest monthly premiums

- Advanced digital tool and platform

- Enroll and cancel at any time

2 – The IHC Group – Best Short-Term Insurance Coverage

The IHC Group is an excellent choice to fill a temporary gap in employer-sponsored health insurance. Short-term medical (STM) plans are considered by many to be the best way to stay covered with health insurance when unemployed.

This insurance coverage is advisable when you are sure the unemployment is temporary and you will likely get employer-sponsored insurance next year. You can buy the STM plans activated the following day, making this one of the best choices for short-term insurance coverage.

However, it’s critical to understand that STM policies may not be ACA-compliant, meaning they might not include certain protections and coverages, such as federally mandated no-cost preventive services.

Pros:

- Flexible terms up to 364 days – coverage begins the next day after applying

- Includes US$ 2 million in annual benefits (varies significantly by plan)

- Optional auxiliary coverage

- plans may be used together with other medical plans, such as life insurance or dental coverage

3 – BlueCross BlueShield – Base Catastrophe Coverage

The BlueCross BlueShield (BCBS) catastrophic insurance policies are the best in the market. It is currently one of the most affordable health insurance options for the unemployed in the market.

Specific unemployed individuals qualify for this low-cost catastrophic coverage, especially those below 30 and some low-income families.

If you fall in the former category, you may need to register in the BCBS’ Young Adult Plan, a policy designed for individuals between 18 and 30 years old who could not afford health insurance otherwise.

According to your region, the BCBS consists of 35 independent companies spread across the US and offers catastrophic coverage under several different names.

Policy terms may vary depending on location, but they all have standard features, such as low premiums, high deductibles, and free access to preventive medicine as required under the Affordable Care Act.

Pros:

- Insurance coverage is available in all 50 states (availability of specific plans, including catastrophic coverage, may vary by state and the individual insurance companies that operate under the BlueCross BlueShield association)

- first, 3 visits are covered at no cost

- Largest provider network

- Dedicated plans for adults below 30 years old

4 – Cigna – Best Telehealth Coverage

Cigna ranks on our list of the best health insurance without a job. All insurance plans include free access to two of the most extensive virtual care networks in the US, which makes Cigna the top choice for telehealth coverage in the country.

If you are unemployed, access to telehealth can be a lifesaver. Telehealth helps you save the time and cost of visiting a doctor’s office and getting remote treatment for minor ailments.

This insurance cover allows free telehealth visits through partnerships with Amwell and MDLive, the two largest telemedicine providers in the United States.

Besides telehealth coverage, Cigna insurance policies also offer in-house customer services 24/7 to help answer your queries and assist. Cigna’s coverage details, including out-of-pocket costs for medications such as insulin, can vary based on the plan, state regulations, and other factors. Specific cost-saving measures for insulin may be available but are not guaranteed across all plans.

Pros:

- Partnership with 2 major telehealth providers

- Offers round-the-clock customer services

- All insurance coverage includes US$ 0 virtual care features

- Dental coverage offered at only US$ 19 per month

To find out more details on eligibility and insurance policies, you can visit the official Cigna website at https://www.cigna.com/contact-us/.

5 – Oscar – Best Full-Family Coverage

Oscar offers a range of health insurance options that might be suitable for families, including those with potential for tax credits. However, the best value for family coverage can depend on individual circumstances, and comparing multiple options is advisable. Oscar has several options to help reduce the cost of family insurance.

Its insurance plans are eligible for tax credits and help to reduce your monthly premiums significantly if your total income is less than four times the federal poverty level.

Some of Oscar’s best insurance policies include a cap on family deductibles, in which your overall deductible will not exceed twice the individual deductible, regardless of the size of your household/family. These reasons, and others, make Oscar the best choice for getting full family coverage when you are unemployed.

Pros:

- Eligible for tax credits

- Comprehensive smartphone app

- Cap on family deductibles

- Free virtual visits

- Free concierge services

Conclusion

This is how you can get health insurance without a job. These top 5 insurance carriers offer the most affordable and comprehensive health insurance coverage for individuals without employee-sponsored insurance as they are out of a job.

Make sure to consult with the policy agent about the pros and cons of each policy to determine the best health insurance policy for you.

It is costly to get medical care and prescription drugs without insurance in the U.S. Here is the list of medical treatments, drugs, and their cost without insurance:

Cost of Medical Carel Without Insurance

See Also

Can Employer Terminate Health Insurance Without Notice?

Medical Insurance for Self Employed

How to Apply for Medical Insurance

Grants for Unemployed Students