Federal Home Care and Family Support Grant – Overview

The pandemic compelled the US government to launch several assistance programs. The reason was that people who usually did not avail of the benefits were suddenly seeking them.

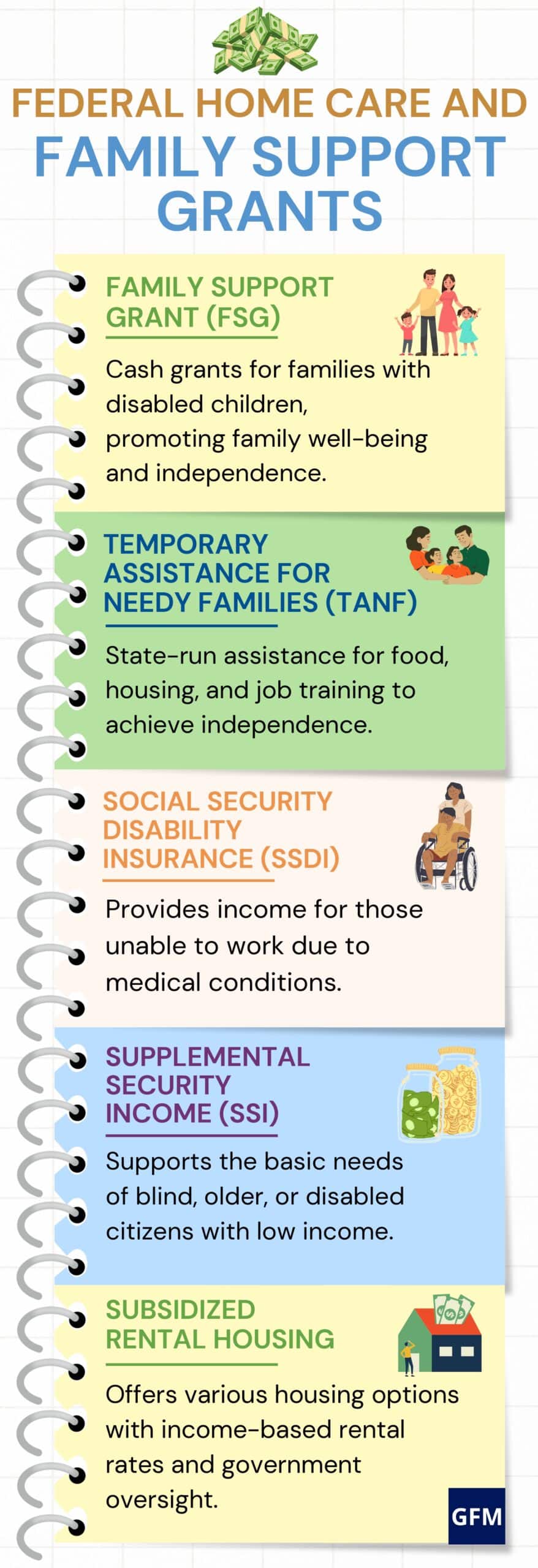

To simplify things, we’ve listed the benefits of some of the top federal public assistance programs launched and improved by the federal and state governments.

Federal Public Assistance Programs

Let’s look at some of the most prominent public assistance programs launched by the US government.

1. Family Support Grant (FSG)

The Family Support Grant (FSG) program offers cash grants to families who have children with certified disabilities.

The aim is to prevent out-of-home replacement of disabled children. It is meant to promote family health and social well-being by giving access to family-centric services and support.

The eligibility criteria for receiving Family Support Grants include:

- The Family Support Grant (FSG) is designed to support families keeping children with disabilities at home.

- Families of children with disabilities (under 25 years of age) who continue to live with their biological or adoptive families.

- Families with disabled children earn annual adjusted gross income (AGI) of $125,635 per year or less.

The FSG grants are offered to eligible families through direct payment to a vendor, voucher or cash.

The exact grant amount will depend on the individual recipient’s needs.

Under this program, every eligible child receives up to $3,113.99 per calendar year. However, the number of grants is not restricted.

This grant amount is meant to offset the expenses directly relevant to a child’s disability.

The grant money cannot buy anything covered by other monetary assistance sources, such as Medicaid Assistance or private insurance providers.

2. Temporary Assistance for Needy Families (TANF)

TANF provides temporary financial assistance and support services to families. It is a federally funded, state-run public assistance initiative.

It is designed to assist families in achieving independence after hard times. Eligible recipients may receive assistance for food, housing, childcare, home energy and job training.

Most TANF recipients are required to participate in work-related activities, such as job training or job search assistance, as a condition of receiving aid.

Every state has its own individual TANF program with varying eligibility criteria. For help, contact your local county social services agency.

You can also call your state TANF office to get local contact information and sign up for the benefits.

Some of the major benefits of TANF include:

- Providing the assistance required by needy families

- Targeting specific help for children

- Supplementing income for employed recipients

- Providing job training to boost independence

3. Social Security Disability Insurance (SSDI)

The Social Security Disability Insurance (SSDI) program is aimed at people who have been unable to work for the last year due to medical conditions.

This program also helps individuals who are expected to die from a medical condition.

Eligibility criteria for SSDI benefits require the applicant to:

- Meet the definition of disability as described by the Social Security department

- Have been employed at a job that has Social Security cover

- Have been employed long enough and recently for disability benefits

Some of the major benefits of the SSDI program include:

- Increase in monthly income

- Freezing record of Social Security earnings

- Chances of getting tax-free income

- Offers rehab and back-to-work benefits

You can find out more details about this program by clicking the link for the Social Security Disability Benefits brochure here https://www.ssa.gov/pubs/EN-05-10029.pdf.

4. Supplemental Security Income (SSI)

Supplemental Security Income (SSI) is a federal income program. It is designed to fulfill the basic needs of blind, older and/or disabled American citizens, especially those with very low or no income.

SSI benefits offer a monthly payment to get food, clothing and shelter. This initiative may also help you to qualify for food stamps and Medicaid insurance coverage.

Eligibility criteria for receiving SSI benefits include:

- Being older than 65 years

- Being blind or otherwise physically disabled

- Having limited income

- Access to restricted resources

- Being a US citizen (or “qualified alien”)

Some of the top benefits of SSI you can expect to include:

- Federal level benefits

- Qualifying for Medicaid and food stamps

- No need for previous work history

- May qualify for concurrent Social Security

5. Subsidized Rental Housing

Currently, three major forms of subsidized rental housing facilities are offered by the US government. These are:

1. Privately owned subsidized housing

2. Housing choice voucher (HCV) program

3. US HUD’s public housing program

Privately owned subsidized housing helps you to find the perfect rental home and apply for it directly at the rental office.

The housing choice voucher program helps you find a house or apartment. The government pays the amount you qualify for, but you must pay the remainder of the total amount under HCV.

HUD public housing is mostly used by people who are not eligible under Section 8 housing.

Under this, you can rent from a local public housing authority, depending on your income. Depending on the location, you may have to wait for a considerable period before your turn comes.

Eligibility criteria for privately owned subsidized housing programs require candidates to:

- Be under the specified income limit of your location

- Have specified numbers of members in the family

- Meet other requirements as set by the property owner

Eligibility criteria for HUD public housing or HCV require you to:

- Be a senior citizen/a family/have a disability

- Fall under program income limits

- Be a US citizen/eligible non-citizen

Some of the major benefits you expect to receive under the subsidized rental housing program include:

- Rental rates that are below the market price

- Benefits of government oversight

- Chance to save for the future

- Various choices and options

To apply for privately owned housing, you can contact the rental office. For applying under HUD and HCV, you should:

- Contact the local Public Housing Authority (PHA) to apply for HUD’s public housing or the Housing Choice Voucher program.

- Submit an application (which includes information on income, family size, bank and employer).

- Include the requested documentation (birth certificates, photo ID and tax returns).

To learn more about eligibility criteria and the application process for these federal funding and public assistance programs, you can visit the official website at https://resources.hud.gov.

Conclusion

The US government offers numerous public assistance programs, including the federal family support grant, subsidized housing, unemployment benefits, and more.

You can research similar initiatives and their benefits.

Before applying, ensure you fulfill the eligibility criteria for any of the above-listed programs. This will ensure that you receive full benefits.

See Also

Blue Cross Blue Shield Telehealth Grants

Blue Cross Blue Shield of Texas

Blue Cross Blue Shield IVF Coverage