How to Get Grants for Medical Bills?

Funding: Criteria for Receiving Grants for Medical Bills

There may come a time in which families become financially handicapped all of a sudden, coupled with the fight against various illnesses.

With cases such as this increasing at an alarming rate, grants for medical bills are now available to help struggling families pay off their outstanding medical bills when money is hard to acquire.

However, remember that applicants must meet specific criteria before they are even considered for grants for medical bills.

Many families have found relief as grant agencies offer assistance to help people manage their medical bills.

You can get help promptly if you follow these criteria when writing your proposals.

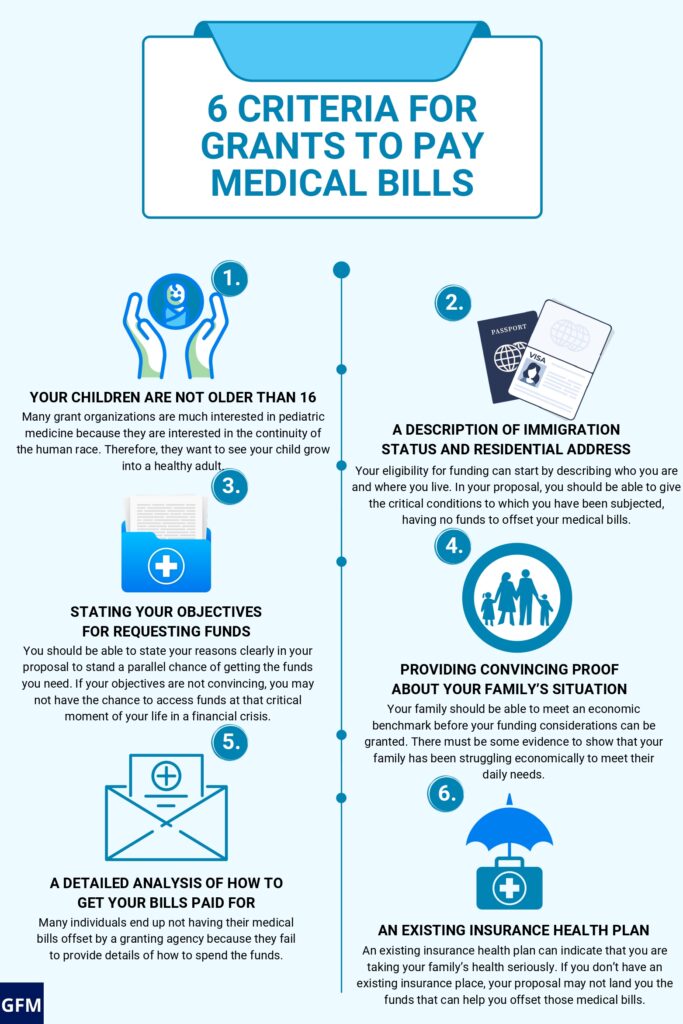

6 Criteria for Grants to Pay Medical Bills

1. Your children are not older than 16

The ages of your children are one of the factors considered for granting you the funds needed for pending medical expenses.

Many grant organizations are very interested in pediatric medicine because they are interested in the continuity of the human race. Therefore, they want to see your child grow into a healthy adult.

On that account, your consideration for a grant will be determined by the age bracket your children fall into.

Once your children are above the age of sixteen, your chances of having your request granted for offsetting your medical bills become very slim.

The reason is that children over sixteen are often considered more self-sufficient, influencing eligibility for certain child-focused grants.

2. A description of immigration status and residential address

In your proposal, you must state your private residence so that your claims can be treated genuinely.

Many grant organizations have specific eligibility requirements that may include citizenship status. The reason is that citizens can be traced easily, and their families are included as beneficiaries of the grant being applied for.

Your eligibility for funding can start by describing who you are and where you live.

In your proposal, you should be able to describe the critical conditions to which you have been subjected, and you should mention that you have no funds to offset your medical bills.

3. Stating your objectives for requesting funds

Why do you need funding? What type of bills do you want to offset, and how soon do you need them passed down?

These are the questions that may likely run through the minds of grant organizations willing to provide a helping hand for families that cannot pay off their medical bills.

You should be able to state your reasons clearly in your proposal to stand a parallel chance of getting the funds you need.

If your objectives are not convincing, you may not have the chance to access funds in a financial crisis at that critical moment of your life.

4. Providing convincing proof about your family’s situation

What will move a grant organization to come to your aid? Your ability to provide convincing proof about the situation has kept you bereft of ideas on how to source funds to offset bills pulled up at a medical facility.

Since you can go to the length of providing pictorial evidence of the ailing patient, as long as they are your family members, you will not belong due to getting a grant.

Also, you can include copies of the medical bills in your proposal, which may help you be considered for funding as early as possible.

Your family’s economic situation is typically assessed to determine eligibility for funding.

There must be some evidence to show that your family has been struggling economically to meet their daily needs.

Moreover, with a clearly stated residential address, you may be considered for funding at that critical hour when you are finding it challenging to help your family because you have no funds to your name.

5. A detailed analysis of how to get your bills paid for

Many individuals do not have their medical bills offset by a granting agency because they fail to provide details of how to spend the funds.

You have to clearly state your intentions in your written proposal on the critical areas in which you intend to spend the funds provided for use.

If your statement is not convincing, you may not qualify for a grand, closing your chances of paying off your accumulated medical bills.

You don’t have to worry about not having enough funds to offset those long-accumulating medical bills.

Help is around the corner as long as you can provide evidence to support your application for a grant to cover medical bills.

On that account, you free yourself from unwarranted pressure because you have to work more hours to offset a bill that appears to snuff the very life out of you.

Clearly stating your intentions and objectives when requesting grants for medical bills can improve your chances of receiving assistance.

Accumulated bills

In your proposal, you can place a copy of the medical bills you have incurred in the space of two months or more before you send in your entries. Your accumulated bills is an indication that you are in a difficult moment to offset them.

With this evidence, a grant organization may decide to grant you funding to clear of those bills in no time. Many families still find it hard to fend properly because they have to shuttle between offsetting a bill and providing daily sustenance.

6. An existing insurance health plan may help

An existing insurance health plan can indicate that you are taking your family’s health seriously.

Having existing health insurance may affect eligibility for some medical bill grants, but it is not universally disqualifying.

Grants for medical bills are available to help families offset bills that have become a significant concern, especially when families are immersed in unpleasant health-related situations.

How and Where to Apply for Grants to Pay Medical Bills?

You can rack up considerable debt from medical bills surprisingly fast. An accident can happen at any time and without warning.

This may result in you requiring hospitalization or at least a visit to the emergency room. The costs of medical treatment and medicines have increased enormously in the past several years.

Being uninsured may result in you accumulating significant debt for your medical treatment and hospitalization, apart from the expensive medicines.

Let’s take a closer look at some of the sources where you can apply for grants to pay medical bills:

1. COBRA

The Consolidation Omnibus Budget Reconciliation Act, or COBRA for short, is highly recommended for those who recently lost their insurance coverage due to unemployment.

This federal law allows an individual to stay on the health insurance plan provided by their former employer for 18 months from the termination date.

However, you need to pay the complete premium.

For more information on the specifics of the grant and the eligibility criteria, we recommend you visit the official website of the US Department of Labor.

2. Medicaid

Medicaid is a state and federally-funded program that provides health coverage to low-income adults, pregnant women, children, the elderly, and the disabled.

To apply for this grant, visit the official website at healthcare.gov/lower-costs and answer three basic questions:

- How many people are in your household? – (This will include yourself, your spouse if you’re married, and anyone you currently claim as tax dependent, even if they might not need the coverage.

- What state do you live in? (Enter the name of the state you live in.)

- What is your estimated household income for the current year? (Select the most likely range. If in doubt, pick one randomly and check the results before selecting the closest range.

Once you’ve answered the questions correctly, click on the “Submit” button at the bottom of the form.

Instantly, you will get the best ways you can increase your savings in your current situation and be able to pay your medical debts successfully.

3. Marketplace Healthcare Insurance

Marketplace healthcare insurance is a government marketplace where you can purchase insurance covers at affordable premiums.

You can enroll anytime if you are eligible for the Special Enrollment Period due to a life event, such as having a baby, moving, getting married, or losing coverage.

When you buy Marketplace healthcare insurance, you must pay the policy premiums directly to the insurance company and not to Health Insurance Marketplace. The insurance cover comes into effect when you pay your first premium.

4. Private Healthcare Insurance Plans

Alternatively, you can buy a health insurance policy for you and your loved ones from private insurance providers. Many insurance companies in the private sector offer health insurance policies at incredibly affordable premiums.

Some of these health insurance plans are designed for low-income and single-parent households.

A simple Google search will list nearby private health insurance providers.

5. Aunt Bertha

Aunt Bertha is an excellent source for finding the organization where you can successfully get grants to pay medical bills. It is a social care network plus an online database of free or affordable human/social services.

These include the details of every private or government organization that deals in medical or healthcare, food, job training, etc.

Once you access the official website, type in your ZIP code and click “Submit”.

Instantly, you will get a list of welfare programs from various categories, including grants to pay medical bills. If you choose the “help pay for health care” category, the database gives you over 280 results.

6. The HealthWell Foundation

The HealthWell Foundation aims to reduce financial obstacles to care for underinsured patients with chronic or disabling disorders.

The foundation offers grants to pay medical bills, such as prescription drugs, health insurance premiums, deductibles, pediatric treatment costs, and travel expenses.

The HealthWell Foundation provides financial aid for various medical costs, impacting numerous patients annually.

To check eligibility, visit the Disease Funds page on the official website of HealthWell Foundation and enter your medical condition.

7. The PAN Foundation

The Patient Access Network (PAN) Foundation helps underinsured people with life-altering, rare and chronic diseases get the required medications and treatments by providing grants to pay medical bills.

This is done to advocate improved accessibility and affordability of healthcare services for all.

To check if you are eligible for financial assistance to pay medical bills from The PAN Foundation, visit their official website at PanFoundation.org, click on the “Get help” option and then select “Apply for Assistance”.

8. NeedyMeds

NeedyMeds is a non-profit organization that provides grants to people to buy prescription medications and cover other medical costs. It is also an informational database that can guide you to the nearest helpful program.

On the NeedyMeds website, you can search for savings by typing the name of any particular medication or diagnosis.

9. Medicare

Medicare is a federal initiative that aids people receiving Social Security payments to cover their medical expenses.

Medicare may be available to a variety of people:

- End-Stage Renal Disease (ESRD)

- People aged 65 and older

- People with disabilities

You could be eligible to receive funding for up to 100% of your medical expenses if you fall into one of these three categories.

However, if you have not paid Medicare taxes for at least ten years, you may not be eligible for Medicare benefits.

10. Children’s Health Insurance Program (CHIP)

The Children’s Health Insurance Program (CHIP) may be available to your kids if they require medical care.

Children in households with insufficient income to be eligible for Medicaid can receive affordable health insurance via CHIP. In some states, the Children’s Health Insurance Program (CHIP) provides coverage for pregnant women.

Every state provides CHIP insurance and collaborates closely with its own Medicaid program. You may be eligible for free or inexpensive medical treatment for your kids.

CHIP offers medical coverage for the following

- Immunization

- Routine check-ups

- Prescriptions

- Doctor visits

- Emergency services

- Dental care

- Vision care

- Laboratory and X-ray services

- Inpatient and outpatient hospital care

11. RIP Medical Debt

RIP Medical Debt uses donations to its non-profit charitable organization to purchase patients’ medical debt from doctors’ offices and hospitals. The hospital sells the debt to RIP Medical Debt rather than a collection agency.

A program administered by RIP Medical Debt forgives medical debt for different groups, including elderly people, veterans, poor, and medical-class families with medical debts.

According to the RIP Medical Debt website, people receiving medical debt forgiveness through their program do not face negative tax or other repercussions.

12. Patient Advocate Foundation (PAF)

The Patient Advocate Foundation (PAF) is a national non-profit organization that offers case management services and financial assistance to Americans with chronic, life-threatening, and incapacitating illnesses.

You can always check the PAF website to discover your eligibility for assistance. PAF can also help you spot problems on your bill and negotiate a lower cost with your healthcare provider.

13. National Organization For Rare Disorders

NORD promotes effective, lasting, and practical change to enable people with rare diseases to live the fullest possible lives.

To support the rare illness community, they deliberately and comprehensively improve care, develop research, and influence policy.

A person must fulfill several medical and financial requirements to be eligible for financial support through NORD.

Grant award amounts vary by program, and it is typical for applications to be cleared on the same day.

14. Leukemia & Lymphoma Society

Many financial aid options are available to leukemia and lymphoma patients through the Leukemia & Lymphoma Society.

Their goal is to eliminate myeloma, Hodgkin’s disease, lymphoma, and leukemia while enhancing the lives of patients and their families.

LLS assists its patients in managing their cancer treatments and ensures they access well-coordinated, high-quality care.

15. RxHope

RxHope lends a helping hand to those in need by assisting them in acquiring life-saving prescriptions that they may otherwise find difficult to purchase.

The quantity of support offered is determined by the standards established by the pharmaceutical firm for the particular medication.

However, you must fulfill certain income requirements to qualify for this program.

Conclusion

Healthcare is a universal right for all. Don’t let a lack of funds restrain you from getting the best medical and healthcare treatment. We highly recommend you visit the official website and confirm your eligibility before applying for grants to pay medical bills.

You don’t have to wait until you are torn down by excessive medical bills when you can get help from organizations ready to offer grants to families, as long as there is proof to validate their economic status, place of residence, and insurance coverage.

Many lives have been saved from extinction because of the positive impact of funding.

You should provide a truthful account of your financial status so that your request for funds will be granted.

If the grant approval process doesn’t go your way, you can always consider getting a loan for medical bills.

FAQs

Are there any government programs that help people with medical bills?

Every government grant for medical bills has specific eligibility criteria and income requirements. The availability of government medical grants may differ depending on your location, requirements, household income, and treatment process.

Which programs offer health care coverage for kids with primary insurance?

The United Healthcare Children's Foundation offers grants to help cover out-of-pocket medical costs for children who have primary health insurance coverage. Primary insurance coverage for children is typically obtained through private insurance, employer-provided plans, or government programs like Medicaid and CHIP.

However, the Children’s Health Insurance Program also offers coverage for immunization, routine check-ups, prescriptions, doctor visits, dental and vision care, and lab services.

Can I take a loan to pay for my medical expenses?

If you are not eligible for free medical grants, you can always apply for medical loans. Various financial institutions and some non-profit organizations offer personal loans that can be used to cover medical expenses. You can pay your bills and return the amount over time.

See Also

Organizations that help pay medical bills

At What Age a Child is Responsible for Medical Bills?

Can You File Bankruptcy on Medical Bills?

Can You Go to Jail for Not Paying Medical Bills?