Does Medicare Cover Long-Term Care – Overview?

Many people will need to use a long-term care facility later in life. However, there is still considerable doubt about whether Medicare covers it.

This is especially true if you or your loved one has Medicare insurance coverage. This article will help you.

What Types Of Long-Term Care Does Medicare Cover?

Before enrolling in Medicare, it is essential to understand the various types of long-term care. Long-term care typically refers to a range of services that are medically necessary for an extended period.

Some standard long-term medical care services include:

Skilled Nursing Facilities (SNF)

Skilled nursing facilities provide a range of health and medical-related services through professional and technical staff.

These facilities monitor, manage and treat health conditions. Staff at an SNF usually includes:

- Physical therapists

- Registered nurses

- Occupational therapists

- Audiologists

- Speech therapists

Normally, one may need to use SNF when:

- Recovering from a serious health disorder/condition, such as a stroke or a heart attack

- Needing occupational or physical therapy after surgery or injury

- Requiring intravenous medications, such as during severe infection or a long illness

Medicare Part A offers to cover the cost of short stays at an SNF in this way:

- Days 1 through 20 – Part A pays the complete cost of all covered services.

- Days 21 through 100 – Part A requires you to pay daily coinsurance payments of $209.50 per day.

- Post 100 days – Part A stop payment and you will have to bear the complete cost of SNF services.

Medicare Supplement (Medigap) can help cover Part A coinsurance and other out-of-pocket costs. Medicare Advantage (Part C) offers alternative ways to receive your Medicare benefits, which may include additional coverage.

Don’t forget to buy these plans when buying your Medicare insurance policy.

In-Home Care

In-home care means getting healthcare services at home instead of at the doctor’s or the hospital.

Home health care agencies usually offer this service. Medicare Part A and Part B cover the cost of in-home care.

In-home services usually include:

- Physical therapy

- Part-time skilled nurses/hands-on care

- Occupational therapy

- Speech-language therapy

Medicare covers only medically necessary in-home care services. Medicare does not cover the costs of cleaning, meal preparation, and custodial care.

Beneficiaries may be responsible for 20% of the Medicare-approved amount for durable medical equipment under Medicare Part B.

However, you may need to pay approximately 20% of the cost of any durable medical equipment (DME), such as walkers or wheelchairs.

Hospice Care

Hospice care is an exceptional healthcare service provided to individuals with a terminal illness. Its purpose is to manage symptoms and provide additional support.

Some examples of hospice care services include:

- Exams and visits from doctors and nurses

- Short-term inpatient care/medications to alleviate pain and ease symptoms

- Medical supplies and devices such as walkers, bandages, etc.

- Occupational and physical therapy

- Short-term respite care at a nursing home or hospital when your regular caregiver is unavailable

- Grief counseling for loved ones and family members in case of a patient’s death

Medicare Part A usually covers the entire cost of hospice care. There are small copays for respite care and prescriptions that you may have to bear.

Medicare does not cover room and board in most hospice settings or treatments intended to cure your illness. Still, it does cover palliative care medications and support for symptom control and pain relief.

This is why it is highly advisable to coordinate with the hospice care team and set an efficient plan.

What Are The Eligibility Criteria For Medicare To Cover Long-Term Care

To receive Medicare benefits for long-term care, you must be eligible for Medicare Part A and Part B. This is done by fulfilling the following requirements:

- Being over 65 years old

- Having a medically proven disability

- Having end-stage renal disease (ESRD)

Once you fulfill these criteria, you are eligible to enroll in Medicare. This, in turn, allows you to receive Medicare coverage for long-term care.

Skilled Nursing Facility Long-Term Care

To qualify for coverage for long-term care at a skilled nursing facility, you should first have a qualifying hospital stay. You should be admitted as an inpatient for at least 3 consecutive days to qualify.

Your doctor should also provide documented proof of your daily inpatient care at an SNF. Typically, patients are transferred to a SNF within 30 days of discharge from the hospital.

In-Home Long Term Care

If you have original Medicare, you qualify for in-home coverage for long-term care. However, this is only after your doctor classifies you as “homebound.”

This means you are unable to leave home without assistance. Your doctor may also advise you to receive skilled medical care at home.

These may include the need for occupational therapy, physical therapy, etc.

Hospice Long-Term Care

To get Medicare coverage for long-term care at a hospice, you will need to fulfill the following requirements:

- Being certified as terminally ill means your estimated life span is less than 6 months

- Choosing to accept palliative care instead of treatment to resolve your condition

- Signing a statement that you choose hospice care instead of other treatments

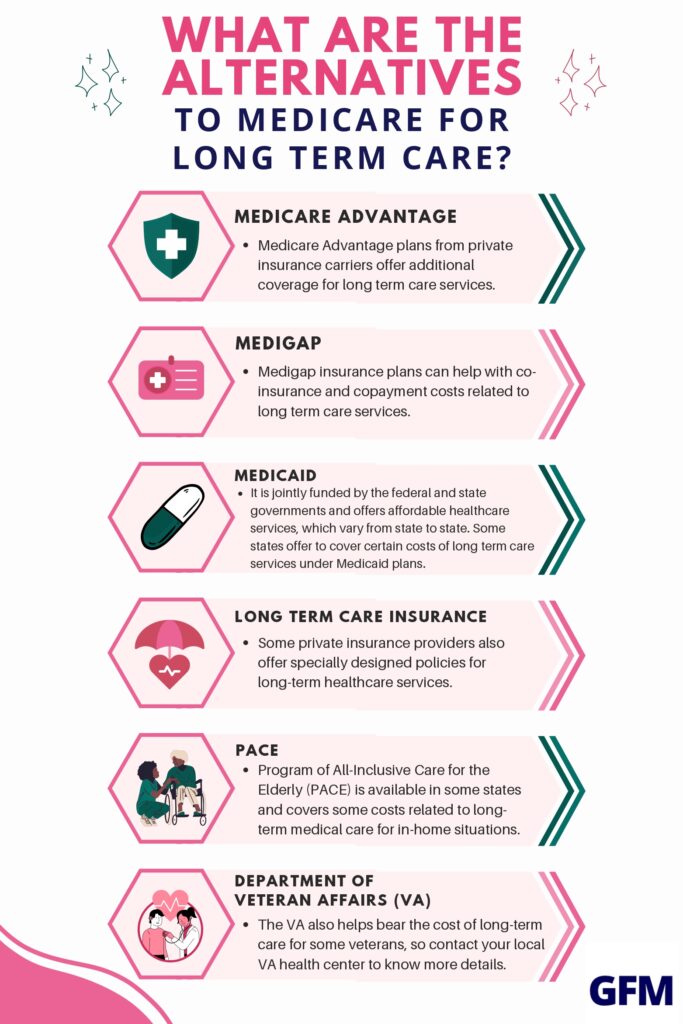

What Are The Alternatives To Medicare For Long-Term Care

Despite offering vast coverage, several areas of long-term care are not covered under Medicare.

For instance, Medicare doesn’t cover the cost of custodial care, which is a major part of living in assisted living facilities and nursing homes.

To help you cover such additional expenses, here are some alternatives to original Medicare:

- Medicare Advantage – Medicare Advantage plans from private insurance carriers offer additional coverage for some long-term care services (for example, limited in-home support services).

- Medigap – Medigap insurance plans can help cover co-insurance and copayment costs associated with long-term care services.

- Medicaid – Medicaid is jointly funded by the federal and state governments and offers affordable healthcare services, which vary from state to state. Medicaid covers certain long-term care services (like nursing home or in-home care) for eligible individuals, but specific benefits vary by state.

- Long Term Care insurance – Some private insurance providers also offer specially designed policies for long-term healthcare services.

- PACE – Program of All-Inclusive Care for the Elderly (PACE) is available in select states and covers certain costs associated with long-term medical care in the home.

- Department of Veterans Affairs (VA)—The VA also helps bear the cost of long-term care for some veterans, so contact your local VA health center for more details.

Conclusion

Medicare does cover some types of long-term care services, including in-home care, short stays at SNFs, and hospice care.

Fulfill the specific requirements to enjoy these benefits. For more information, please get in touch with your local Medicare office or representative.

See Also

Does Medicare Cover Shingles Shots

Does Medicare Cover Chiropractic

Does Medicare Cover Hearing Aids