A life insurance policy has become crucial for everyone as it provides financial protection to your loved ones when you are gone. When choosing the right life insurance policy for your loved ones, most people confuse life insurance and whole life insurance.

So, what is the difference between term and whole life insurance? Let’s find out the answer!

What is the Difference Between Term and Whole Life Insurance – Overview

Term and life insurance are two of the oldest and most popular plans. As the name suggests, whole life insurance provides lifelong coverage. It’s a type of permanent life insurance that stays with you all your life. Whole life insurance premiums can be fixed or flexible, offering a cash value component that grows over time.

On the other hand, term life insurance requires premiums for a certain period. For a term life policy, premiums are paid throughout the term duration, such as 15 years, not for a shorter period, like nine years. Term life insurance covers a specified term; benefits are only paid out if the insured dies within this term.

With more awareness, life insurance providers come up with complicated plans that confuse the people around them. To help them get the right life insurance, we have differentiated two of the most popular life insurance types: term life insurance and whole life insurance.

Term Life Insurance

Term life insurance is the easiest life insurance plan. The policy has a fixed premium and premium-paying terms. You pay the premiums, and your beneficiaries receive the death benefit if you die within the term period; there is no maturity benefit. Most people choose term life insurance because it gives the beneficiaries an assured death benefit.

Term life insurance has a specific term, such as five years, ten years, fifteen years, and so on. Once the policy expires, there is no payout, as term life insurance does not typically include a maturity benefit. It’s a simple way to protect your family.

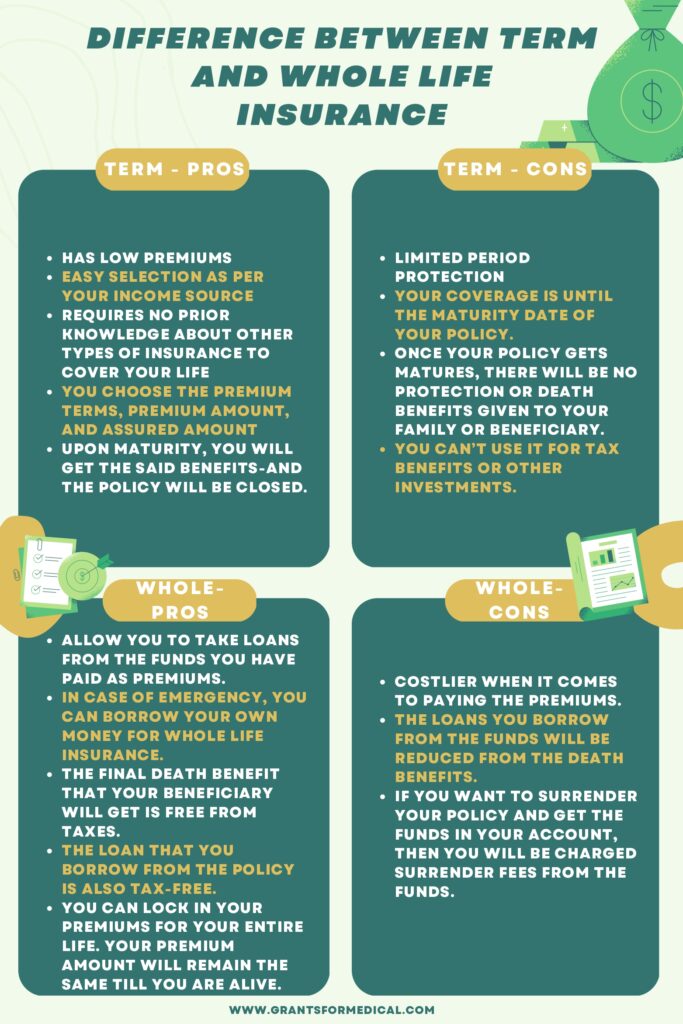

Pros:

Term life insurance has low premiums compared to other types of life insurance. Term insurance premiums are easy to select based on your income source. You can choose the policy term and premium-paying terms based on your income to cover your life.

Term life insurance is straightforward, providing death benefit protection without investment components. You choose the premium terms, premium amount, and assured amount. Upon maturity, you will receive the benefits, and the policy will be closed.

Cons:

Limited period protection. Unlike whole life insurance, your coverage is until the maturity date of your policy. Once your policy matures, no protection or death benefits will be given to your family or beneficiary.

It’s a simple insurance plan. Term life insurance does not have a cash value component and does not offer investment opportunities or tax benefits related to cash value growth.

Whole Life Insurance

Whole life insurance is permanent life insurance that provides lifelong coverage and includes a cash value component. Unlike term insurance, whole life insurance never expires. The policy will remain in force as soon as you pay your premiums.

Moreover, whole life insurance provides cash value at the end of your policy and death benefits. This will add some more funds to its actual amount.

Whole life insurance is associated with the market. Premiums for whole life insurance are split between the insurance cost and the policy’s cash value, which grows over time but not necessarily in a half-and-half division.

Unlike term life insurance, whole life insurance comes with great flexibility. You can adjust the premium terms and other things in this policy. You can even grow your funds by investing in various investment platforms.

Pros:

Whole life insurance policies allow you to borrow money from the premiums you have paid. You can borrow money for your needs and repay it, or the amount will be deducted from the policy’s final benefits. In an emergency, you can borrow your money for whole life insurance.

The death benefit from a whole life insurance policy is generally tax-free to the beneficiary. The loan you take out from the policy is also tax-free. However, you need to understand taxes when you borrow money from your funds.

The premiums are flexible. You can even lock in your premiums for your entire life. Your premium amount will remain the same till you are alive.

Cons:

Unlike term life insurance, whole life insurance is costlier when it comes to premiums. However, the premium amount is in your control. Once you pay your first premium, you can choose the right amount.

The loans you borrow from the funds will be reduced from the death benefits. If you borrow some money from the funds paid as premiums, your beneficiary will get a lesser amount.

If you want to surrender your policy and get the funds in your account, then you will be charged surrender fees from the funds.

Which Insurance is Better for Me

Many people ask the same question because they can’t determine the differences between term and whole life insurance. Well, both insurances have pros and cons. Which policy is better for you depends upon your needs.

Term life insurance is suitable for those needing coverage for a specific period, like 20 years, providing a death benefit if the insured dies during this term. It assures you and protects your life for 20 years, i.e., the policy term. Once the policy’s period is over, the policy will be over. Regarding life insurance, there are no payouts upon policy expiration as there are no maturity benefits or bonuses.

If you need permanent life coverage until you die, whole life insurance is for you. It comes with several benefits while you are alive and makes your family financially free, as the beneficiary will get the benefits after you pass away.

You have to decide which life insurance is suitable for your needs. If you have a limited source of income, then we would recommend going with the term life insurance as it will give you maturity benefits at the end of the selected term. You can use your funds wherever you want.

The Bottom Line:

Whole life insurance is a good choice for those who want more benefits as it adds cash value as you age. On the other hand, term life insurance also comes with many benefits, as you will get assurance of funds upon completing your policy terms. You must choose the right insurance type according to your needs and wants.

See Also

What is Universal Life Insurance

What is Short Term Medical Insurance