EDD Disability – Overview

The State of California’s Employment Development Department (EDD) is part of the State Disability Insurance (SDI) program. Under this program, eligible individuals are provided partial income replacement benefits.

This program provides financial support to California workers unable to work due to non-work-related illnesses, injuries, or pregnancy. The EDD pays SDI compensation to California workers through employee payroll deductions.

While disability insurance provides monetary benefits, job protection may be provided under other laws like the FMLA. However, you may have job protection through other state or federal laws, such as FMLA (Family and Medical Leave Act).

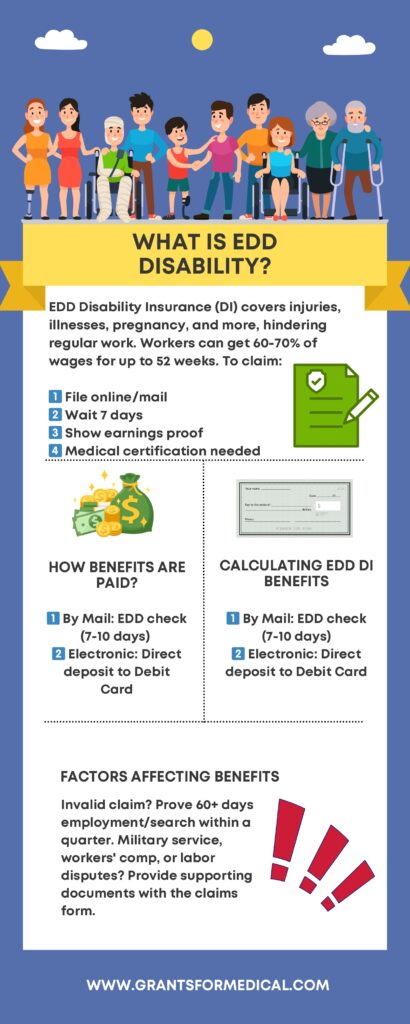

What is EDD Disability

The EDD disability insurance (DI) defines disability as any injury or illness (mental or physical) that prevents an individual from performing their regular and customary work. Disability includes conditions like pregnancy, childbirth, and elective surgery, impacting the ability to work.

Several workers’ compensation laws cover work-related disabilities. While EDD DI typically covers non-work-related disabilities, there are specific situations where work-related conditions might be eligible.

Eligible candidates for EDD DI can receive approximately 60% to 70% of their wages, based on their income, typically within a few weeks after the claim is processed. Individuals eligible for EDD DI benefits can receive them for a maximum of 52 weeks.

If you want to receive EDD DI benefits, then you will need to follow the steps given below:

- You must be incapacitated from performing your normal work duties for at least eight days.

- Experience a loss of income due to your disability.

- Be either employed or actively seeking employment at the onset of your disability.

- Accumulate at least $300 in earnings, from which deductions for State Disability Insurance (SDI) were taken, within your base period. For details on how this affects your benefits, see Calculating Benefit Payment Amounts.

- Within the first eight days of becoming disabled, you must receive care and treatment from a licensed physician or an accredited religious practitioner. If this requirement isn’t initially met, the start date of your claim may be adjusted. Ongoing care and treatment are necessary to maintain your eligibility for benefits.

How Are EDD Disability Benefits Paid

If you are found to be eligible for EDD DI benefits, then the EDD will issue payments using one of two methods:

Payment by mail – Payments are issued via EDD debit cards or checks, typically within 7 to 10 business days.

Electronic payment – Benefits are issued to an EDD Debit Card allowing direct deposits.

You can expect to receive EDD DI benefits soon after you prove you meet all eligibility requirements. The EDD will authorize your benefits as soon as you are eligible. Benefits are paid after eligibility is proven and are typically processed daily.

This rate is usually around 1/7th of your weekly benefit amount. Remember, you should allow ten days from receiving confirmation for the DI benefits.

How are EDD DI Benefits Calculated

EDD DI benefit amounts are based on the applicant’s wages during a 12-month base period. This base period is decided according to the date your claim is in effect.

You should carefully consider the day you start your claim, which may affect your weekly benefit rate. The application date will also determine the maximum benefit amount and the duration of your benefits eligibility.

To qualify, an individual must have earned at least USD 300 during the base period. The month your claim becomes effective determines which of the four consecutive fiscal quarters are used.

For instance, if your claim begins in January, February, or March, the base period is the 12 months ending last September.

What Will Affect EDD DI Benefits

The original statement about qualifying by proving employment or job-searching efforts for 60 days in any quarter of the base period is not a standard EDD DI requirement and should be disregarded.

The ability to use substitute wages from previous fiscal year quarters to qualify for or increase your benefit amount is not a standard option within the EDD DI program and should not be considered applicable. However, the criteria for this include the following:

- Having served in the military

- Receiving workers’ compensation benefits

- Having not worked because of a labor dispute

If your circumstances fit any of the above, you should include a letter, supporting documentation, and the claims form.

EDD Disability – FAQs

Who is eligible for EDD benefits for disabilities?

Employees must fulfill the eligibility requirements to qualify for the EDD disability payments. To be eligible for EDD disability payments, they must be unable to perform their usual employment duties for at least eight days due to illness or injury.

How long do EDD benefits last?

EDD DI payments are available to eligible people for a maximum of 52 consecutive weeks. Candidates who meet the requirements for the EDD DI program receive compensation of up to 60% to 70% of their salary shortly after their claim is processed.

What does the California State Disability Insurance Program provide?

The California State Disability Insurance (SDI) program offers Paid Family Leave (PFL) and short-term Disability Insurance (DI) to eligible employees. If a non-work-related illness, accident, pregnancy, or delivery prevents you from working, you can apply for Disability Insurance (DI).

Conclusion

Applicants have the right to understand the reasoning behind any decision affecting their disability benefits within the EDD DI program. Therefore, you should appeal any decision regarding your eligibility for benefits. You can send the appeal directly to the DI office in writing.

You may request an appeal hearing before an Administrative Law Judge (ALJ) or appeal the judge’s decision to your state’s Unemployment Insurance Appeals Board and the local civil courts.

Find out more details and information on eligibility criteria and benefits of EDD DI by visiting the official website at https://edd.ca.gov/en/Disability/About_DI.

See Also

Long Term Disability Insurance

Dental Insurance for Senior Citizens